The provincial government has unveiled a new infrastructure strategy, announcing plans to create a new Ontario Infrastructure Bank.

The new arms-length agency will be responsible for attracting investors to participate in large-scale critical infrastructure projects, with proposed initial funding of $3 billion from the government.

The Doug Ford government will also allot an additional $100 million to the Invest Ontario Fund, for a total of $500 million, to enable Invest Ontario, the government’s investment attraction agency, to help attract companies to the province and support existing ones.

In addition, the government proposed spending $200 million over three years in a new Housing-Enabling Water Systems Fund, for the repair, rehabilitation and expansion of a variety of municipal water infrastructure projects.

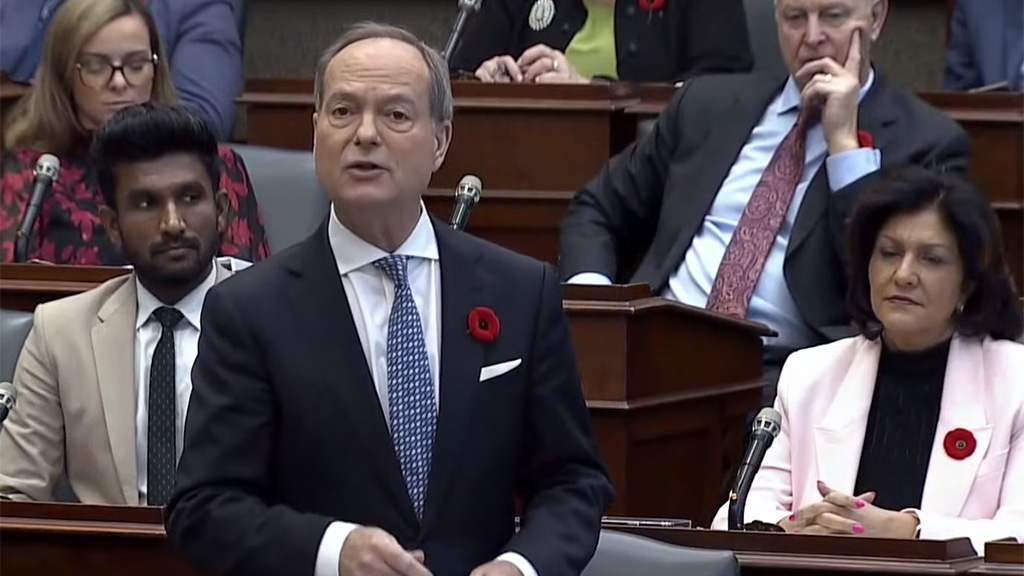

The infrastructure announcements were delivered by the province’s Minister of Finance Peter Bethlenfalvy as he tabled the government’s 2023 Ontario Economic Outlook and Fiscal Review in the Ontario legislature today (Nov. 2).

“Our government is introducing new tools to attract institutional investments to help build more infrastructure that would otherwise not get built,” the finance minister said.

The infrastructure bank would attempt to leverage investments by public-sector pension plans and other Canadian institutional investors.

At the outset, the projects financed through the new agency will be focused on long-term care homes, energy infrastructure, affordable housing, municipal and community infrastructure and transportation, Bethlenfalvy said.

“Having institutional investor support will help the government build more infrastructure, while creating opportunities for Canadian pension funds to put their members’ investments to work right here at home.”

A background document stated the Ontario Infrastructure Bank’s board would have the authority to select projects and project partners.

The bank will work with Infrastructure Ontario, which will continue to progress through public tendering of all projects that have been assigned to it, the government said.

Another new infrastructure commitment in the economic statement was a proposal to boost critical mineral exploration through an additional $12 million per year in tax credit support. The government would expand eligibility of the Ontario Focused Flow-Through Share Tax Credit to include critical minerals that qualify for the federal Critical Mineral Exploration tax credit, starting with the 2023 tax year.

Bethlenfalvy also reiterated the government’s support for the mining sector through its Ontario Made Manufacturing Investment Tax Credit. He restated its commitments to the refurbishments of Darlington and Bruce nuclear generating stations and the extension of the Pickering nuclear generating station to 2026; construction of North America’s first grid-scale Small Modular Reactor; starting pre-development work for a large-scale nuclear station; planning new transmission lines; and procuring long-duration storage projects.

“We are building the critical infrastructure needed to support our growing communities,” the finance minister said. “We are training workers to fill the jobs needed in key sectors like health care and the skilled trades, while also helping them plan for their retirement.”

Steps to support the construction of rental housing include the government’s previously announced plans to offer GST relief for new purpose-built rental housing and enhance the Ontario HST New

Residential Rental Property Rebate by removing the eight per cent provincial portion of the HST on qualifying new purpose-built rental housing.

The government is projecting a deficit of $5.6 billion this year, decreasing to $5.3 billion next year, and a small surplus in 2026. The new deficit forecast for this year is a hike of $4.3 billion from the outlook published in the 2023 Budget, reflecting updated economic and revenue information and higher contingencies for near-term risks, the government said.

Ontario’s real GDP is projected to rise 1.1 per cent in 2023, 0.5 per cent in 2024, 2.0 per cent in 2025 and 2.8 per cent in 2026.

Comparatively, the forecast is for stronger growth in both real and nominal GDP in 2023 and slower growth between 2024 and 2025, with growth strengthening in 2026.

The government also foresees stronger employment growth in 2023 followed by slower job creation in 2024 and 2025; and higher projected housing starts in all years and weaker home resales in 2023 and 2024, followed by a strong rebound in 2025.

Follow the author on Twitter .

Recent Comments

comments for this post are closed