Construction economists assembled for a recent economic forecast webinar offered a mixed bag of predictions for the sector in the medium term, with one, Alex Carrick, suggesting he is finding the negative indicators are outweighing the good.

The Nov. 8 webcast was billed as the Construction Economy Outlook Fall Webcast and focused primarily on the U.S. market.

Besides Carrick, who is chief economist with ����ӰԺ, included ����ӰԺ senior economist Michael Guckes; Ken Simonson, chief economist with the Associated General Contractors of America (AGC); and American Institute of Architects (AIA) chief economist Kermit Baker. ����ӰԺ was a co-sponsor.

Claire Stubblefield, vice-president of product strategy with ����ӰԺ, also participated.

The presenters found plenty of positive nuggets to highlight, such as continued strength in hotels, entertainment and sewer and watermain construction as well as a bullish megaproject sector with funding for some projects now being sourced from private equity, but Carrick injected a dose of reality.

“I’ve got to say that the list of negatives was much easier to come up with than the list of positives,” he said.

“A year ago I was very optimistic about almost everything economy-related but because of interest rates staying high for longer than I expected, and some things that are happening on the geopolitical side, and the fact that China has kind of taken itself out of the growth path, I’m not as optimistic now as I was.”

Baker looked at three sets of data from a recent AIA report and admitted, “I think we’re dealing with a triple whammy there. Billings, new contracts and backlog, all softening simultaneously.”

On the positive side, Carrick noted, U.S. real GDP grew by a “torrid” 4.9 per cent in Q3 2023, annualized quarter to quarter; the energy transition movement guarantees huge capital spending; there’s a wealth of opportunities in the new industries that are arising; and megaprojects will guarantee many billions in capital spending.

There is tremendous and maybe unstoppable growth in the entertainment and travel sectors, Carrick said, and it appears the fossil fuel industry may not yet be down for the count, with spending still forecast for LNG facilities.

“Entering 2023 it did not seem likely that there would be the same number of megaprojects this year as there were last year,” he remarked. “But surprise, surprise, there has been almost exactly the same number, for almost exactly the same dollar amount, as last year.”

But his list of impediments to future growth was long. Interest rates look to maintain their current high levels for longer than expected, Carrick said. Strains in the office building sector are now a broad threat to owners, small banks and insurance companies, and there is widespread labour unrest, coupled with costly wage settlements.

Other indicators bringing gloom to the sector include a drop in the Rider Levett Bucknall crane count of 10 per cent versus six months ago, and Fitch’s downgrade of U.S. federal government debt.

Both Carrick and Simonson warned of the threat caused by the faltering labour pool. There is good news on the supply chain side, Simonson said, with material costs and lead times improved from a year or two back except for electrical gear, some electronics and other materials. This means that labour availability has resumed being the number one challenge for many contractors.

However, input costs can be highly volatile and unpredictable, Simonson said.

“Cement prices have been rising at 11 per cent rate, ready mix concrete almost 10 per cent. And then other things are extremely volatile in both directions,” he said.

“Things can turn around very quickly in either direction.”

Medium term, Simonson said, homebuilding appears poised for slow recovery, but a slowdown is likely in multifamily, warehouse, retail, office and lodging due to rising interest rates. Data centre and manufacturing construction, meanwhile, should remain hot.

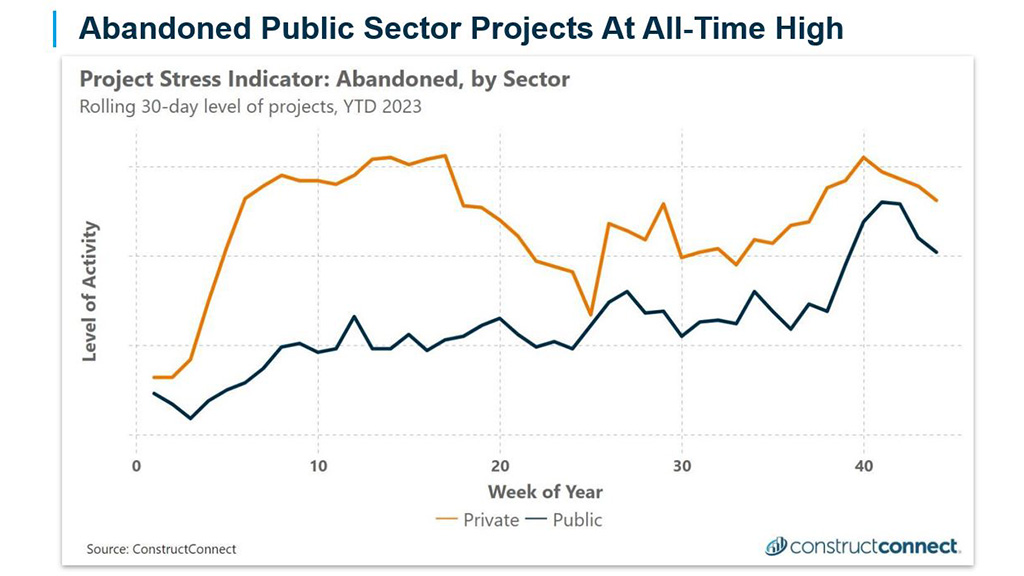

Guckes has introduced his own index called the Project Stress Index reflecting abandoned projects, projects that are on hold and projects with a delayed bid date. The index has been rising in recent months, a trend that continued in October. One component of the project stress indicator, abandoned public sector projects, is at an all-time high.

Labour productivity, Guckes thinks, may be a greater long-run problem than availability.

Addressing the architecture sector, Baker said billings have been weak since Q3 of last year and took a tumble in September. New design contracts have also stalled, suggesting workloads are unlikely to rebound anytime soon. Among sectors documented in the AIA/Deltek Architecture Billings Index, multifamily residential is the main sector pulling down scores, while institutional seems to have most upside potential.

Among positive signs, Baker said, spending on the construction of buildings has been very strong so far in 2023 with nonresidential building spending up 20.5 per cent comparing January to September totals for 2022 and 2023. Commercial is up 29.4 per cent for that period and institutional has risen 9.9 per cent.

Follow the author on Twitter @.

Recent Comments

comments for this post are closed