Capital spending rebounds, hits record high in 2021 Őż

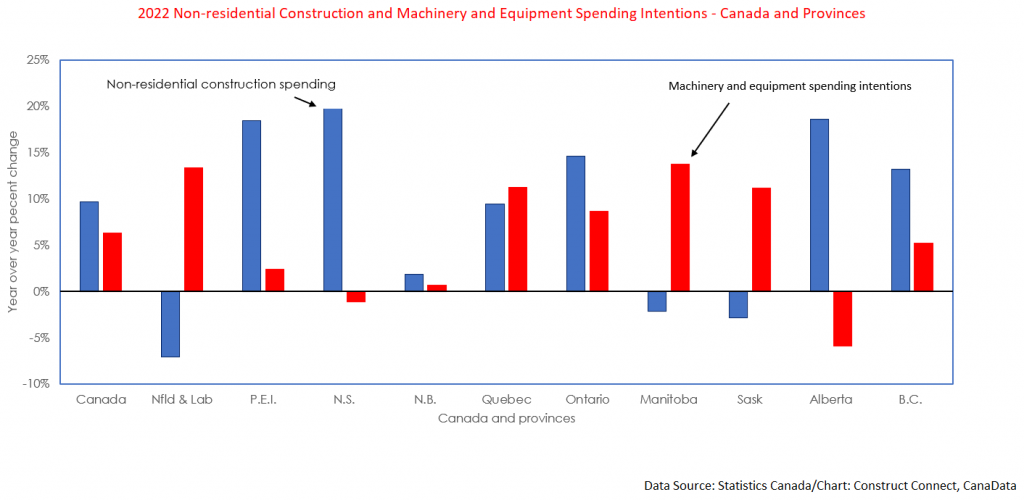

Against the headwinds of the Delta and Omicron variants of COVID-19, supply chain shortages, and record-high job vacancy rates in the construction industry, nominal capital expenditures on non-residential construction and machinery and equipment in Canada increased by +10.4% in 2021. This gain, the largest since 2010, was well ahead of the +7% rise projected by the Non-residential Capital and Repair Expenditures (CAPEX) survey at the beginning of last year. Most of the larger-than-expected increase was due to accelerated spending on public sector projects that jumped by +13.6% in 2021, following a COVID-19-depressed bump of just +1.5% in 2020.Őż

Public CAPEX outpaces private in 6 of 10 provinces

Provincially, a +15% jump in public sector CAPEX and a +10% rebound in spending on private sector projects caused total capital spending in Ontario to rise by +12% in 2021, a three-year high. ŐżApproximately a quarter of the increase was due to a +20% year-over-year increase in spending on transportation projects (think subways) and warehouses (i.e., distribution centres).

Non-res capital spending in Quebec rose by +20% in 2021 after contracting by -6% in 2020. Gains in spending on both public (+11%) and private (+10%) sector projects contributed to the increase. More than half the climb in capital spending in Quebec originated with resource-based industries, including mining and quarrying (+30%) and utilities (+21%).

Capital spending in British Columbia posted an +11% increase in 2021 supported by a +20% jump in public sector CAPEX and a +6% rise in private sector spending.Őż From an industrial perspective, spending by BC‚Äôs resource-based industries, specifically mining, quarrying, and oil and gas extraction, accounted for approximately 60% of the gain in total capital spending.

Őż

Geopolitical uncertainty clouds CAPEX outlook

Before reviewing the outlook, it is useful to evaluate the fundamentals affecting private sector projects, since they are more influenced by domestic and external economic conditions than are those in the public sector. Topping the list, of course, is the recent Russian invasion of Ukraine and the heightened uncertainty about the negative impact of higher oil prices on inflation.

Although the health of the global political environment has deteriorated of late, the domestic drivers of private sector investment in Canada remain quite strong. After dropping by -45% q/q SAAR in Q3/2021, after-tax corporate profits of non-financial corporations rebounded by +68% in Q4/2021. Although events in Ukraine have recently unsettled investors, the S&P/TSX stock price index has not experienced a major price correction and remains up +40% since mid-2020. ŐżŐż

Given the steady rise in headline inflation since April of 2021, few were surprised when the Bank of Canada raised its ‚Äėovernight rate‚Äô on March 2 by 0.25 percentage points to 0.50%. While the Bank noted in its policy announcement that it will need to raise rates further, we do not expect these increases will be large enough to cause firms to put a significant number of major projects on hold in 2022. However, the rate hikes may hurt more in 2023.

Inflation erodes ‚Äúreal‚ÄĚ value of CAPEX

During the past several decades of relatively ‚Äútame‚ÄĚ inflation, the divergence between nominal and ‚Äúreal‚ÄĚ (i.e., inflation-adjusted) capital spending has been small.Őż However, the acceleration in prices of most building materials over the past 12 months will force budget-constrained public and private organizations to scale back their “real” capital expenditures. This prospect is reinforced by labour shortages in the construction sector.

Energy and infrastructure to drive 2022 CAPEX

According to the latest CAPEX survey, the nominal value of non-residential (public + private) capital spending will total $298 billion in 2022, up by $23 billion from the estimated $275 billion spent in 2021.

Spending in Ontario is estimated to total a record $99 billion, up by $8.2B (+9%) compared to 2021. Just over a third of the gain will be due to increased spending on transportation projects, mostly in the Greater Toronto Area (GTA).

In Quebec, the CAPEX survey reports public sector capital spending will rise by +15% versus a private sector increase of +8.5%. Major public sector projects will include the Apuiat Wind Farm project and the Varennes Carbon Recycling biofuel project.

In B.C. solid growth of both public (+7.7%) and private (+6.8%) CAPEX should boost total spending by +7.2% in 2022 following an increase of +11.2% in 2021. Major projects expected include the Surrey Langley Skytrain and the renewal of the Burnaby Hospital. Plus, there’s ongoing Trans Mountain Pipeline and Coastal Gaslink work.

Spurred on by the quadrupling of oil prices since mid-2020, total capital spending in Alberta is projected to increase by $2.5 billion in 2022, with oil and gas exploration +24%. Major undertakings which may contribute to this increase include the Foster Creek Expansion project, the Aspen Oil Sands project, and the Alberta Xpress Expansion project.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments

comments for this post are closed