The Russian invasion of Ukraine has handicapped and crippled the economies of both those nations, but it has also indirectly given a significant boost to Saskatchewan in three ways.

First, since the beginning of this year, the sharp -25% drop in Russian potash exports has driven the world price of this essential agricultural fertilizer up by +178% from $202/ton to $562/ton, its highest level since mid-2008. Fuelled by this surge in price, Saskatchewan, with 30% of world reserves, has seen its exports of potash jump by +159% year to date. Nutrien Ltd., the world’s largest potash producer, plans to ramp up its annual production to 18 million tons by 2025, a +40% increase.��

Second, restrictions on Russian oil exports, which have helped to drive the price of crude up by +50%, have caused Saskatchewan’s exports of petroleum in the first half of 2020 to increase by +45% y/y.��

Third, there’s been a recent announcement by the BHP Group that it plans to accelerate the construction of its Jansen potash mine which, when production begins in 2026, will be one of the largest in the world. The outlook for non-residential construction spending in Saskatchewan could also be supported by the CanPacific Albany Potash project, the Lake Diefenbaker Irrigation Project, and the Saskatoon Freeway Project.

Ag industry prospects bright, but a cloud

After being severely depressed by drought in 2021, Saskatchewan’s agricultural outlook has brightened considerably due to increased precipitation that has boosted crop yields. According to the Saskatchewan Wheat Development Commission, “the condition of spring wheat crops in Canada and the Northern Plains is indicative of very strong production” following a drought-depressed crop last year.

The combination of increased production and upward pressure on prices due to weaker Russian and Ukrainian exports should cause the province’s agricultural sector to make a much larger contribution to growth this year and next compared to 2021. One major risk to the future health of the province’s farming and mining sectors, however, is the federal government’s recently proposed introduction of rules to reduce the use of nitrogen fertilizer.

According to the Canadian Federation of Independent Business, these plans have helped sink the short and long-term outlooks for the agricultural industry to the lowest among the country’s 13 major industries. Also, if enacted, reduced crop yields might push up food inflation which at +9.2% y/y currently is the highest it’s been since 1982.����

Slowing job growth dampens consumer confidence

Consistent with the strong growth of exports, a +38% year-to-date increase in rig counts, and a +19% year-to-date rise in non-residential construction, hiring in the province picked up early this year. However, since March, total employment has declined in four of the past five months, due in large part to a retreat in part-time hiring which has largely offset gains in full-time employment. Given the combination of slower job growth and the spectre of higher interest rates, it is not surprising that consumer confidence trended lower in July, as did plans to make a major purchase.��

Higher interest rates are cooling consumer spending and housing demand

Reflecting softening job growth, the associated decline in consumer confidence, and the eroding impact of escalating inflation on real disposable incomes, Saskatchewan’s inflation-adjusted retail sales contracted by -2.2% SAAR Q/Q in the second quarter. At the same time, housing demand, reflected by sales of existing homes, has softened after peaking late in 2021. As a result, the year-over-year increase in house prices has retreated from +6.2% y/y in January to +2.1% in July.

While the outlook for residential construction is overshadowed by the effect of higher interest rates, demand should be supported by the recent strong rise in the inflow of permanent residents into the province, coupled with a decline in household size that was highlighted in a recent Vanguard Realty report titled .��

These two factors help explain why the number of applications to build new dwellings in Saskatchewan year to date is up by +14% vs 2021. We estimate housing starts will total 4,400 units this year and 4,100 units in 2023 vs 4,300 units in 2021.

Bottom line

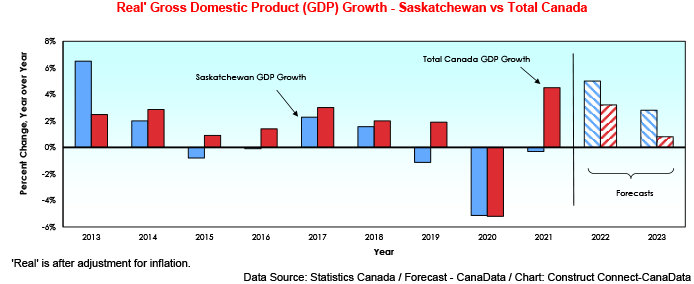

There is little doubt higher interest rates aimed at cooling inflation will dampen the growth of housing demand and consumer spending in Saskatchewan well into 2023.�� However, the negative effects of higher interest rates should be partly offset by the above-noted gains in resource-based exports and the solid growth expected in non-residential construction.

John Clinkard has over 35 years’ experience as an economist in international, national and regional research and analysis with leading financial institutions and media outlets in Canada.

Recent Comments

comments for this post are closed