2022 snapshot

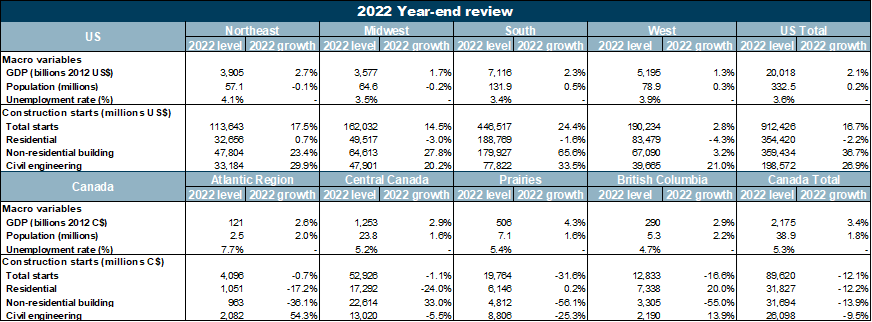

US construction starts grew 16.7% in 2022 to $912 billion. A record value for mega-projects (projects valued above $1 billion) was posted in 2022 with 31 such projects started for a total value of $105.3 billion. Non-residential building starts grew 36.7%, driven by new factory building. Civil engineering starts grew 26.9% in 2022 with all sectors expanding except for the miscellaneous civil engineering sector. New residential construction, by contrast, fell 2.2%. On a regional basis, new construction grew in all four major regions, led by construction in the South.��

Canadian construction starts declined 12.1% in 2022 to C$89.6 billion. New construction for residential building, non-residential building, and civil engineering all declined at a similar pace of 12.2%, 13.9%, and 9.5% respectively. There were large divergences in growth across the non-residential and civil engineering sectors, and unlike in the US, growth dynamics were not driven by mega-projects.

U.S. year in review

US GDP had a slow start to the year, contracting in each of the first two quarters. However, the composition of growth was less worrying as inventory destocking contributed to the negative reads early in the year. Economic growth rebounded in each of Q3 and Q4 with full-year growth in 2022 coming in at 2.1%. High inflation—with the consumer price index (CPI) peaking at 9.1% year-on-year (y/y) in June—was a major theme in 2022. While CPI inflation has eased back since then, ending the year at 6.5% y/y, it remains considerably above the Federal Reserve’s 2% target. In March, the Fed raised its benchmark interest rate by 25 basis points (bps), beginning a series of aggressive rate hikes. This was followed by a 50bps increase in May, then four successive 75bps increases in June, July, September, and November, before a final 50bps rise in December. The policy rate ended the year in a range of 4.25-4.5%, and the Fed increased its rate a further 25bps at its meeting in February 2023. Higher interest rates have fed through to 30-year fixed mortgage rates, which peaked above 7% in November.

Despite the rapid rise in interest rates, the US labor market remains tight. The economy added an average of 375,000 jobs per month through 2022, although monthly job growth in the final quarter fell below 300,000 before picking up again to 517,000 in January 2023. The unemployment rate ended the year at 3.5% in December, equalling its pre-pandemic low, and it fell further to 3.4% in January. Labor force participation, however, remains more than 1 percentage point below its pre-pandemic high, which is contributing to the tightness in the labor market. Wages also increased, but not enough to compensate for rising prices. Average hourly earnings growth averaged 5.2% in 2022 overall, and by year-end, they had slowed to 4.4% y/y in January 2023.

Construction material inflation soared in early-2022 but had come down markedly by the end of the year. Construction material inflation peaked at 35.1% in December 2021 and was still at 34.8% in January 2022. However, it fell into deflation territory by year-end. Likewise, prices for construction inputs, excluding capital, labor and imports, slowed from a peak of 23.7% year-on-year (y/y) growth in March 2022 to 7.1% growth in December. Lumber, metals, and energy cost inflation is generally coming down or in deflation territory, while price inflation for concrete, cement, and related products remains high. Prices for final demand for construction, which reflects prices that firms are able to charge, grew 18.5% y/y in December, down slightly from a peak of 23.1% in July. Output price inflation generally lagged input price inflation through most of 2020 and 2021. The acceleration in output prices in 2022 reflects a convergence in the two measures and suggesting that construction firms are better able to pass on increases in their costs.

As elsewhere in the economy, labor shortages were an issue in the construction sector throughout 2022. The JOLTS survey of job openings hovered around record highs, and the construction sector unemployment rate averaged 5.4% in 2022, a 2.5 percentage point drop from its 2021 average. Annual growth in both hourly earnings and weekly earnings has outpaced the economy-wide average, suggested firms are raising pay to attract workers.

New construction starts grew 16.7% in 2022 to a value of $912 billion. This was the strongest pace of growth since the series began in 2005 and follows on from growth of 10.8% in 2021. In current dollar terms, US construction is 10% above its pre-pandemic high in 2019. 2022 also saw a record value for mega-projects, or projects valued above $1 billion. There were 31 such projects recorded in 2022 for a total value of $105.3 billion, up from the previous record in 2019 when the total value of large projects was $79.1 billion.

Non-residential building starts posted the strongest rise in 2022, up 36.7%. New factory building was a major driver of this increase, with new construction activity up 204% in the sector. Fourteen of last year’s mega-projects were categorized in manufacturing, with large projects mainly seen in strategic sectors such as oil and gas, semiconductor fabs, and electric vehicle battery factories. Some of the largest such projects included three new semiconductor factories: a $15 billion Texas Instruments site in Texas, a $9 billion Samsung factory, also in Texas, and an $8 billion Taiwan Semiconductor Manufacturing Company plant in Arizona. The other major project started in the manufacturing sector was a $10 billion LNG facility in Louisiana.

Outside of manufacturing, new hospital construction was another non-residential segment with multiple mega-projects, including two in Pennsylvania, and one each in Indiana and Massachusetts. Hospital starts grew 27.4% in 2022. Other sectors that grew strongly in 2022 include smaller sectors such as police and fire and industrial laboratories, which grew 43.5% and 82.6% respectively. New hotel construction grew 38.8%, but after steep pandemic-era declines, it remains some 65% below its previous peak in 2017. Private office building, another pandemic-hit sector, continued to decline in 2022 and is now 45% below its 2019 peak.

New engineering starts grew 26.9% in 2022 with all sectors growing on the year except for the miscellaneous civil engineering sector. New power infrastructure projects had the largest number of mega-projects: a $1 billion gas facility in Texas, a $4.5 billion transmission cable from Canada to New York, and a $1 billion solar array in Nevada. The sector grew 58.2% in 2022 following on from 98% growth in 2021. In general, it is a key sector for new green projects, so is likely to see additional large projects started in the coming years. Elsewhere in engineering, new construction for airports, bridges, roads, and water, sewage, and treatment projects all increased at a double-digit pace with mega-projects started in both the bridge and roads sectors.

After initially leading construction following the pandemic, new residential construction fell back in 2022, shrinking 2.2% for the year. Single-family housebuilding led the decline, down 11.6%. Single-family starts had grown 10.3% and 17.5% in 2020 and 2021 respectively, as the pandemic increased demand for larger houses outside of city centers. But as the economy reopened, people returned to cities. This, combined with squeezed affordability conditions due to higher mortgage rates and elevated prices has caused demand for single-family housing to retreat. New apartment building, by contrast, increased 20.9% in 2022 due to high rents and a housing shortage in city centers.

On a regional basis, construction starts in all four of the major regions grew in 2022. The South posted the fast growth of new construction, up 24.4%. Several of this year’s large projects were in Texas, underpinning new factory building in particular. Both the Northeast and Midwest also grew at a double-digit pace. The West increased just 2.8%, but it has also been the strongest performing region in 2021. In all four regions, the sectoral composition of construction largely followed the national profile—weaker residential construction with growth in non-residential building and civil engineering. Residential construction only grew in the Northeast, albeit by just 0.7%. By contrast, new civil engineering and non-residential building grew at a double-digit pace in all regions, except for non-residential building in the West.

Canada year in review

Canadian GDP is estimated to have grown 3.4% in 2022 with data through Q3. A house price correction began in earnest in the spring, and by December, house prices were 13% below their peak in February 2022. The decline in housing dragged down residential investment by an estimated 10.5% in 2022, but business investment and household spending were both resilient, growing 8% and 4.6% respectively. Like in the US, inflation was on an upward trajectory early in the year, peaking at 8.1% in June. Inflation has eased back since then and was 6.3% in December. The Bank of Canada began a program of raising interest rates in March, initially by 25bps to 0.5%. Since then, it has increased its policy rate seven more times—including a 100bps increase in July—and the policy rate currently sits at 4.5%. While it increased rates 25bps in January 2023, the Bank of Canada signalled its intentions to hold the policy rate at its current level in order assess the impact of past interest rate increases on the economy. The interest rate on a 5-year fixed rate mortgage increased by nearly 250bps through the course of the year.

Canadian construction starts fell 12.1% in 2022 with similar rates of declines of 12.2%, 13.9%, and 9.5% in residential, non-residential building, and civil engineering projects respectively. In the residential sector, both single-family and multi-family construction starts fell at a similar rate, by 12.1% and 12.4% respectively. The decline in new residential construction mirrors that in house prices, so last year’s weakness was to be expected. ��

Within the non-residential building segment, there were huge variations in new construction activity in 2022. On the one hand, government office building, miscellaneous retail, miscellaneous medical, and transportation terminals all posted triple digit rises. Of these sectors, the only mega project was for a $3 billion government office project in Ontario. New factory building was another sector to see mega-projects—a $5 billion battery factory in Windsor, Ontario, for example. However, a $7.5 billion potash mine started in Saskatchewan in 2021 fell out of the annual calculation, and as a result, new construction in the sector declined 28.3%. On the downside in non-residential, new religious facilities, hospitals, parking garages, and private office building all declined by more than 40%. Of these, private office building is the most stark—new construction activity in 2022 was 81% below its 2019 peak. In general, volumes in Canada are smaller than in the US, so often see large swings in annual growth rates.

New construction of civil engineering projects fell in almost all sectors in 2022. The exception was in dams, canals, and marine projects, which grew 88.2%. Power infrastructure starts posted the steepest decline, of 48.8%, although it had grown 45% in 2021. Miscellaneous civil projects decreased 15.3% in 2022, and after three years of contraction, is 72% below its peak in 2019.

Recent Comments

comments for this post are closed