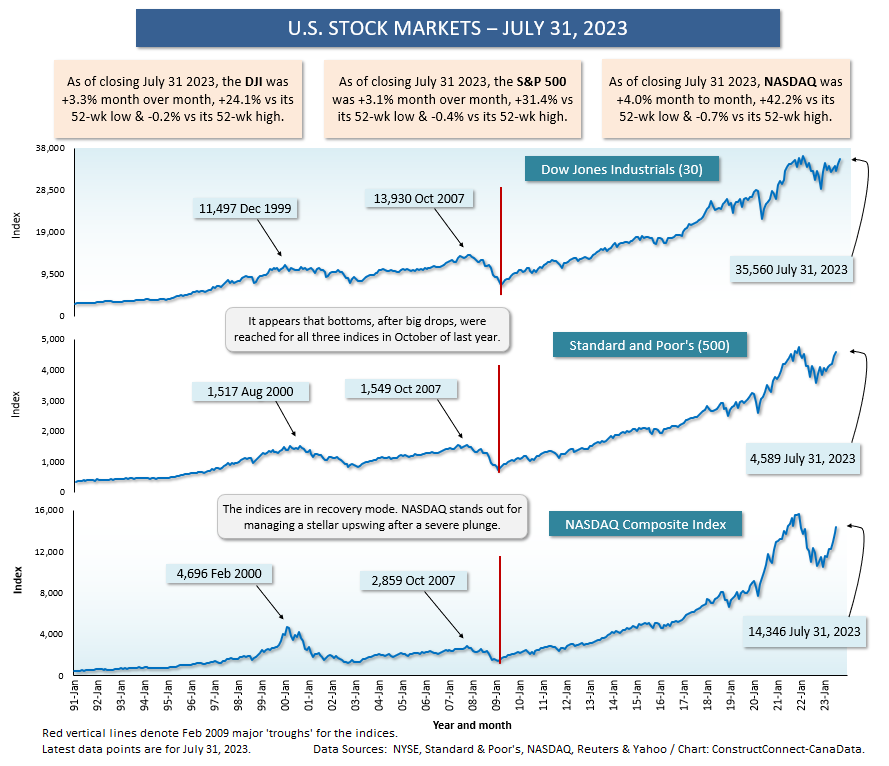

In the Fall of last year, considerable anxiety was induced among investors when the world’s major stock market indices plummeted.

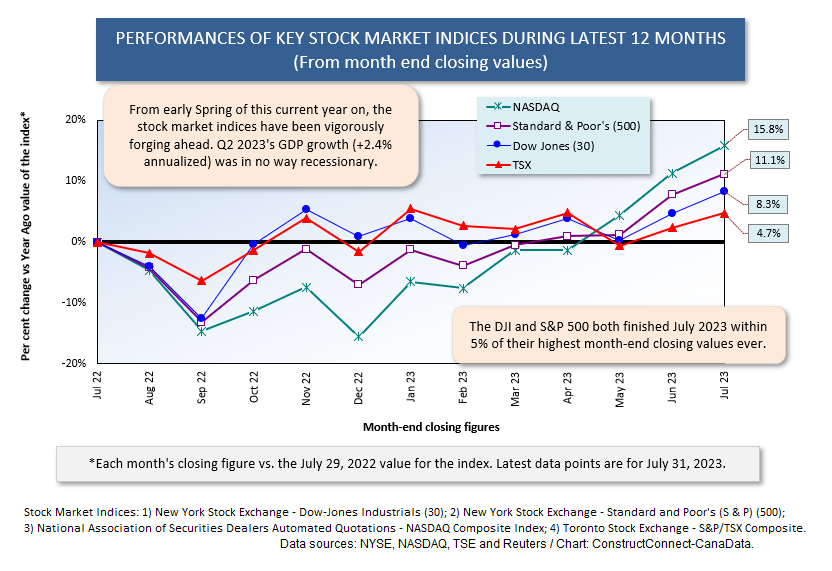

Now, it is nice to be able to report that those days are over. As of July 2023’s month-end closing values, both the DJI and S&P 500 were within 5% of their previous all-time highs; NASDAQ has climbed back to within 10%.

Now, it is nice to be able to report that those days are over. As of July 2023’s month-end closing values, both the DJI and S&P 500 were within 5% of their previous all-time highs; NASDAQ has climbed back to within 10%.

Early in August, a small wrinkle to investing enthusiasm has been delivered by Fitch’s downgrade of U.S. government debt from AAA (i.e., as good as it gets) to AA+ (just a shade below ‘rock solid’).

The timing and the reasoning are interesting. Fitch does not like the fact Washington keeps running into a debt ceiling and there is always a game of brinkmanship in Congress before it is resolved. This does not speak well of America’s efforts at good governance, according to Fitch.

That there is wrangling over the debt ceiling, however, is hardly fresh news.

There are four major rating agencies: Fitch, Standard & Poor’s; Moody’s; and DBRS. The only other agency to give U.S. debt a less than full endorsement is Standard & Poor’s, which moved the meter to AA+ in 2011. Moody’s is at Aaa and DBRS, at AAA.

The gold standards for ratings among nations (i.e., top notch across the board) are to be found in Germany, Switzerland, Singapore, Australia, and some of the countries in Scandinavia.

Canada is not quite in the top tier. While its debt is viewed as premier by the other three rating firms, Fitch is carrying Canada at AA+, same as now prevails for the U.S.

The stock markets do not seem to be much fazed by Fitch’s negative U.S. assessment.

A ratings’ downgrade usually necessitates a hike in interest rates. That has already happened in the U.S. and has been taken about as far as it can go. The Federal Reserve is in control of U.S. interest rates and, concerning their direction and extent of change, is not going to be pushed off what it views as most desirable.

Plus, the Fed knows that, at least for the foreseeable future, international investors will continue to view the U.S. dollar as the currency of last resort (i.e., the safest of havens) regardless of the blemish just placed on it by Fitch.

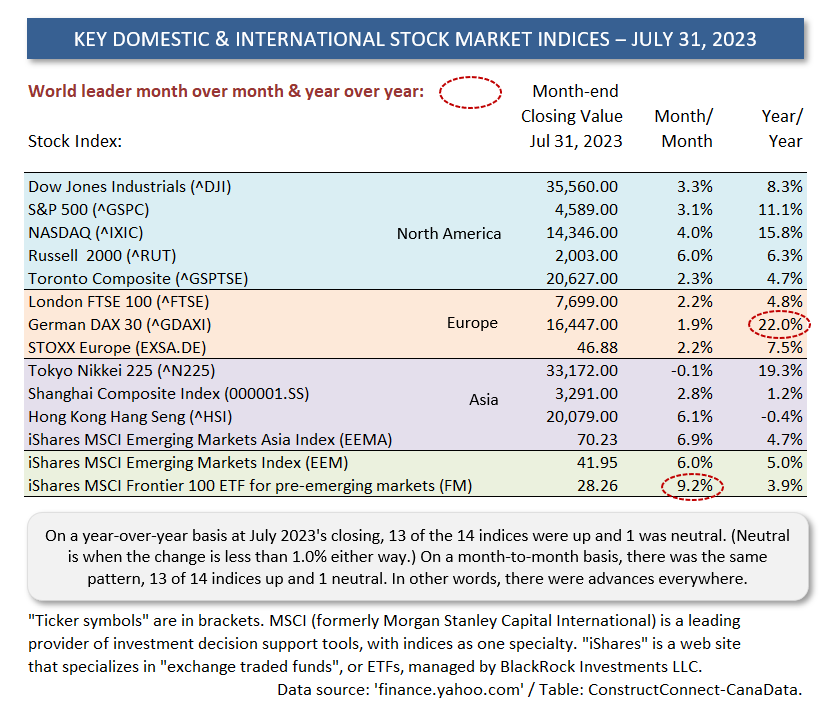

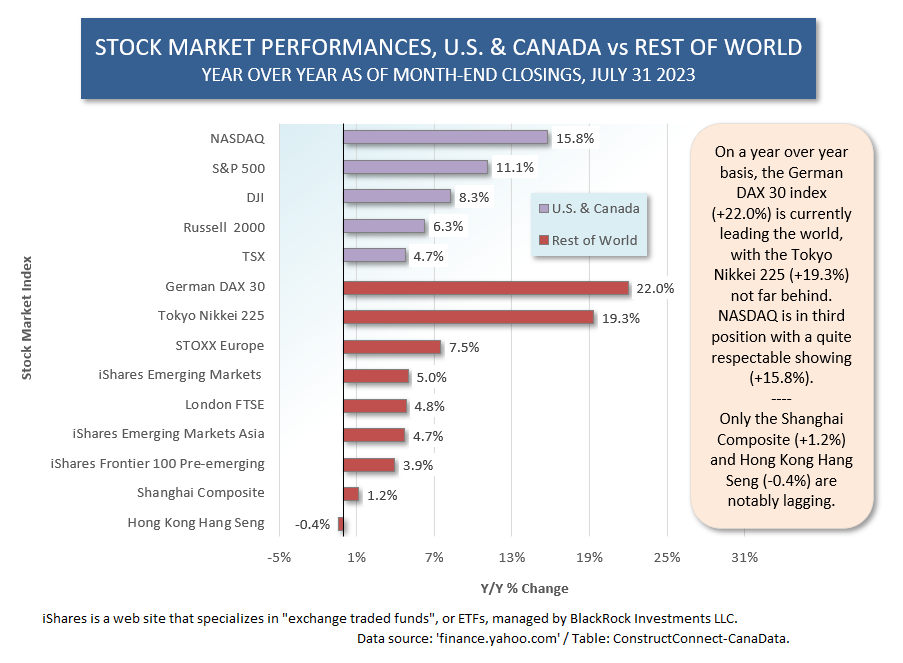

Speaking of Germany, the German DAX 30 is currently leading all major international stock market indices for year over year change, +22.0%. The Tokyo Nikkei is in second place, with a gain of +19.3%.

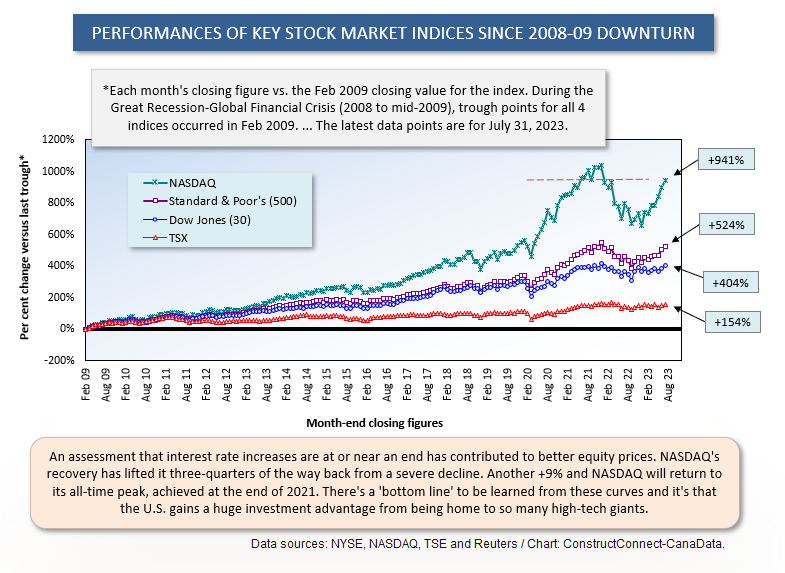

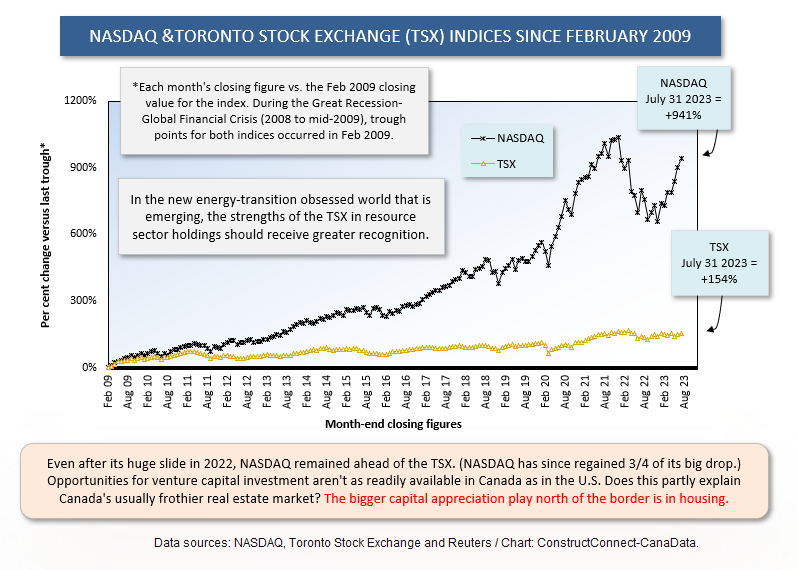

NASDAQ, which is burning rubber (+15.8% y/y) among U.S. indices, can claim only a third-place position globally. But what should never be forgotten about NASDAQ is that it is up by tenfold over the past 14 years and that puts it in a class of its own.

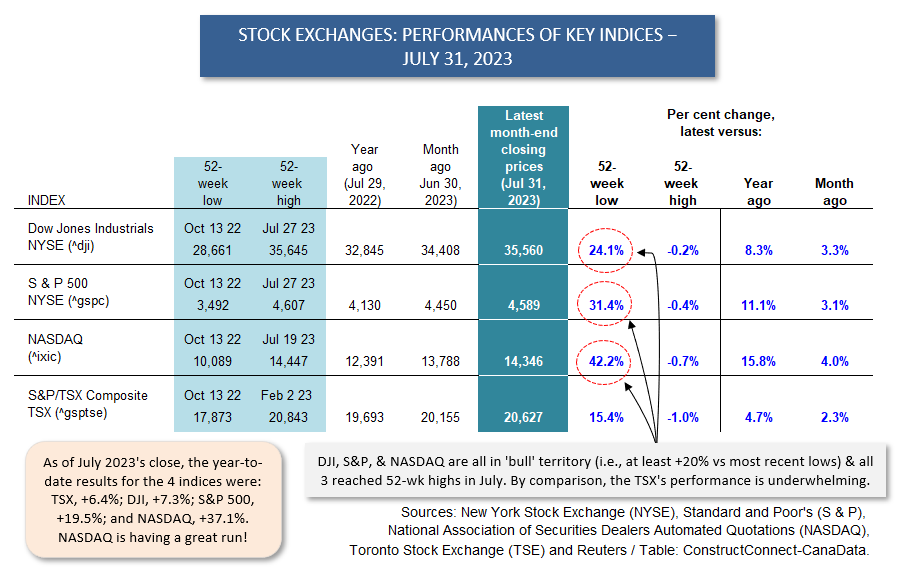

Table 1

Graph 1

Graph 2

Graph 3

Graph 4

Table 2

Graph 5

Alex Carrick is Chief Economist for ����ӰԺ. He has delivered presentations throughout North America on the U.S., Canadian and world construction outlooks. Mr. Carrick has been with the company since 1985. Links to his numerous articles are featured on Twitter��, which has 50,000 followers.

Recent Comments

comments for this post are closed